SYSTEMATIC ANALYSIS AND DISCOVERY TEST

– Rigorous historical tests and facts finding across the years.

– Measure the actual alpha contribution of any fundamental, quantitative, trend parameters of your interest.

– Compare the results, explore any combination of rules and optimize the analysis.

– Discover the most profitable sequence of selection parameters.

– Document with objective historical data.

DISCRETIONARY MANAGEMENT

Pick the analysis that you like.

Integrate the intelligent information into your current process.

Enrich your decision process with additional smart insights.

Maximize your performance.

SYSTEMATIC MANAGEMENT

Check more boxes, refine the selection process and boost your returns.

Save time.

Document the investment process robustness with sound, historical evidence.

Execute with consistency and discipline.

The opportunity for better returns and lower risks.

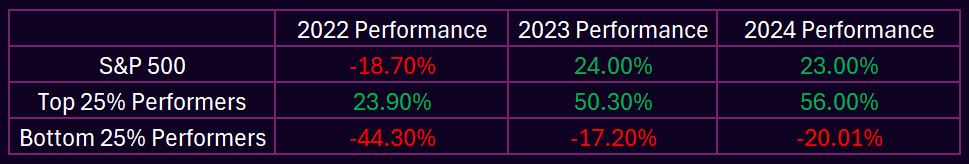

Performance Dispersion facts – This was the dispersion in the S&P 500 universe in 2022, 2023 and 2024.

The ability to discriminate between winners and losers can have a big impact on returns. Investors who can maximize their portfolio exposure to stocks in the top 25% while limiting their positions across the bottom 25% can easily deliver superior returns in any market environment. Sound stock selection intelligence can exploit the dispersion and capture the outperformers, generating superior returns consistently.

The best-performing stocks tend to share strong fundamentals, the foundation of price increases, and validated positive trends, the factual confirmation of investors appreciation. While the worst performing display a combination of poor fundamentals and a negative price trend.

Performance dispersion opportunities selection guidelines to discriminate:

Top 25% Performers = Strong Fundamentals + Positive Trend.

Bottom 25% Performers = Poor Fundamentals + Negative Trend.

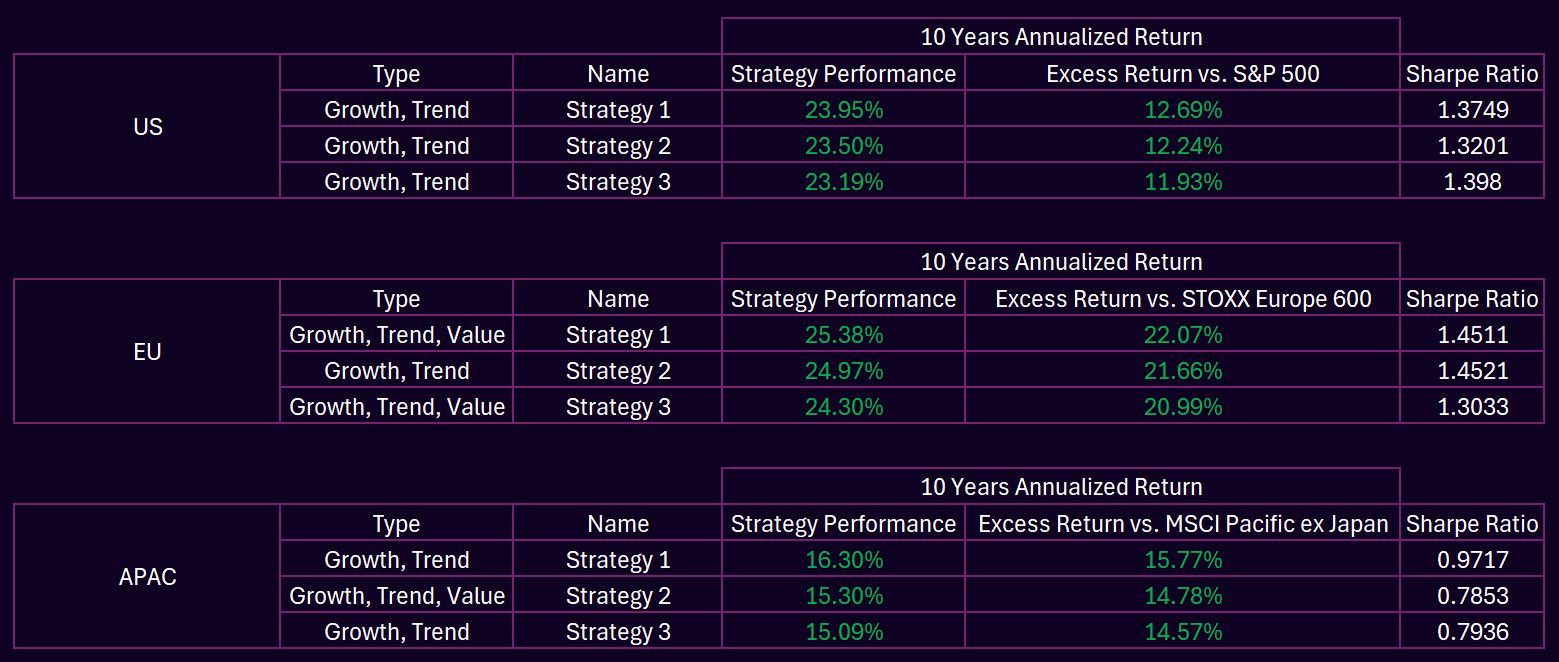

Below you find a few example strategies within the Trendrating system. Data as of December 31, 2024.

Contact us to gain free access to our platform. See the detailed selection rules and lists of stocks.

SUPERIOR RETURNS

Can be obtained by carefully combining selected parameters and by checking more quality boxes.

Gain an extra layer of intelligence by using the Trendrating solutions. Learn how our unique platform can give you an edge and join a community of hundreds of forefront active managers.

What our clients say

“The enlightening insights about the actual contribution to the alpha of popular fundamental parameters enabled me to improve my decision process.” – Fund Manager, UK.

“A great technology to explore and discover the most productive combinations of selection rules.” – Asset Manager, Frankfurt.

“Finally a system offering better information with actual value to navigate the market.” – Advisor, Zurich.

“This is gold for active portfolio managers!” – Portfolio Manager, Sweden

“I save time and filter out the market noise thanks to Trendrating.” – RIA, Miami.

“Building better model portfolios is easy and fast with this great tool.” – Wealth Manager, Boston.

“The strategy builder is a game changer for developing superior active strategies.” – ETF Manager, NY.

“The ability to select and document well-tested, logical rules gives me an edge in marketing my services.” – RIA, Chicago.

“The market intelligence and the discipline that I extract from Trendrating gives me more confidence than the conventional data and tools.” – Asset Manager, Singapore.

“The knowledge from rigorous fact-finding is the basis of a sound investment decision process. Trendrating is providing the information I want, well done!” – Wealth Manager, Dubai.

Advanced Technology To Build Winning Strategies

Leverage your skills and maximize your opportunities with smarter tools like 300+ global institutions are already doing. Fill the below form to get your free trial. A Trendrating representative will contact you within 24 hours.